1. Expansion of Prediction Markets Beyond Sports

Betting exchange sites are evolving into broader prediction markets. Platforms like Kalshi, now a CFTC‑regulated exchange, let users trade event‑based contracts—yes/no for elections, inflation rates, award shows, and even long‑term sports futures. Additionally, Robinhood has integrated prediction‑market style features via Kalshi, supporting bets on events from basketball tournaments to Fed interest‑rate moves Business Insider. This crossover is ushering in a hybrid between betting exchange sites and financial-style trading platforms.

2. U.S. Exchange Market Gaining Traction

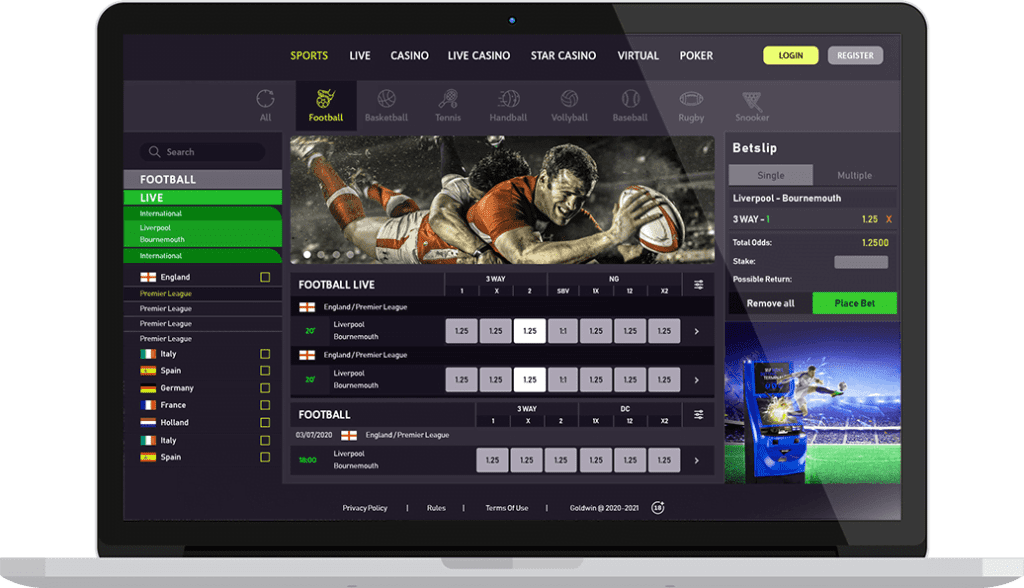

The U.S. legal landscape is finally opening up to exchange-style betting. New entrants like Prophet Exchange have launched in states like New Jersey, offering P2P matching with tight spreads and mobile-friendly apps—although still limited in sport selection and parlay options. Meanwhile, sweepstakes-based models (e.g. Crypto.com) and stateside regulators are loosening, setting the stage for fully regulated exchange betting solutions.

3. Lower Fees, Higher Liquidity

Leading exchange platforms continue to drive down costs and boost liquidity. Sites like Smarkets, Matchbook, and Betfair Exchange are now offering commissions as low as 2%, with promotions offering zero‑commission signups. Exchanges are also investing in deeper liquid pools in popular sports to support matched bettors, especially football and horse racing .

4. Smart Tech: AI and Machine‑Learning Tools

AI-driven enhancements are becoming mainstream. Tools like Dimers Pro provide predictive analytics and simulations for better-informed bets. On the research front, ML techniques such as XGBoost are being applied to optimize dynamic in-play wager placement on betting exchange simulators. These innovations are helping both traders and the platforms themselves make sharper trade-offs and pricing decisions.

5. Decentralization & On‑Chain Innovation

Blockchain-powered, decentralized betting systems are emerging. Projects like UBET’s on‑chain automated market maker (AMM) allow for non-custodial, transparent, and global betting exchanges, bypassing traditional hurdles. Though still niche, these decentralized exchanges could disrupt betting exchange sites by increasing transparency and trust without centralized oversight.

6. Traditional Operators Adopting Exchange Models

Legacy bookmakers are integrating exchange-style options. In the UK, EasyBet (from EasyGroup/easyJet) operates via Matchbook’s exchange API. In regulated markets like Brazil (launched January 2025), established sites including Betfair are combining fixed-odds and exchange offerings, providing cross‑adaptive betting experiences.

7. Regulatory & Regional Developments

New jurisdictions—Brazil’s recent January 2025 launch for fixed-odds betting is noteworthy—are encouraging licensed exchange operators . In the U.S., CFTC-approved platforms like Kalshi now allow regulated election/event contracts, and Prophet Exchange is exploring sportsbook licensing. Regulatory systems are catching up with these next-gen betting exchange sites.

Summary

Betting exchange sites are rapidly evolving—from sports-only P2P models to diversified prediction markets, AI-driven tools, regulated U.S. platforms, hybrid sportsbook integrations, and even blockchain-based exchanges. Expect future competition with traditional sportsbooks and a user experience that blends dynamic trading, smarter bet placement, and global market access.

The Road Ahead

-

Deeper liquidity & cross-border access: As more regulated exchanges emerge globally, liquidity will spread beyond top-tier sports.

-

AI personalization: Smarter analytics and bet automation could become standard tools.

-

Regulatory clarity: As prediction markets gain traction, expect clearer oversight in more regions.

The world of betting exchange sites is entering a transformative era—seamlessly merging trading, tech, and traditional betting in unexpected ways.